Keystone Baltic M&A Watch – 2015 H1 overview

Main highlights

- 121 M&A transactions in the Baltic states (January-June 2015)

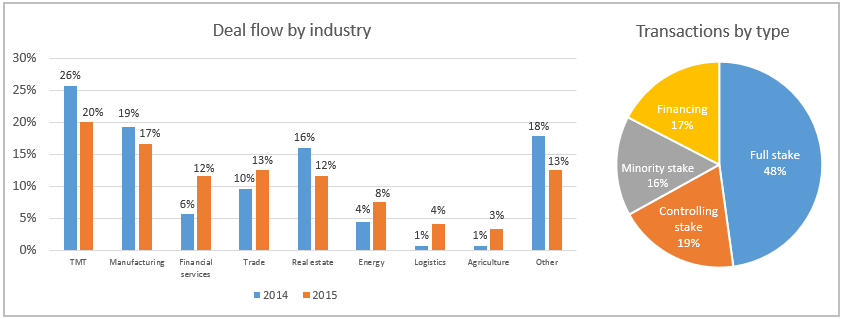

- TMT trails as most active industry sector with 20% of all the counted transactions

- Improving access to variety of financing sources should encourage outbound M&A activity

The market remains active

After a considerable increase in 2014, the number of M&A transactions in the Baltic States has decreased in the first half of 2015, however, the market remained active. According to Keystone Baltic M&A Watch data, in H1 2015 there were 121 M&A transactions in the Baltic States, compared to 161 transactions in H1 2014.

According to the target company‘s geographic location, 36% of all transactions were in Estonia, 27% in Lithuania, 21% in Latvia and 19% in other countries (i.e. Baltic companies acquired entities abroad or Baltic companies were part of transaction covering several geographies). According to our estimates, two-thirds of the M&A activity appeared among the micro-caps, meaning transaction values under 5 million EUR and mostly domestic deals.

Among the largest transactions with disclosed values it’s worth mentioning:

- In February Switzerland based investment management company Partners Group acquired 163 million EUR worth portfolio of commercial real estate in the Baltic states and Poland;

- In May Estonian forestry and bioenergy group Graanul Invest acquired Latvian pellet manufacturer “SIA Latgran” for 104 million EUR in a flagship transaction that established Graanul Invest as the largest pellet producer in Europe.

Market situation encourages consolidation

In H1 2015 trends in the Baltic market remained similar as last year. Main activity was observed in technology, media and telecommunications (hereinafter- „TMT“) with every fifth deal happening in this sector.

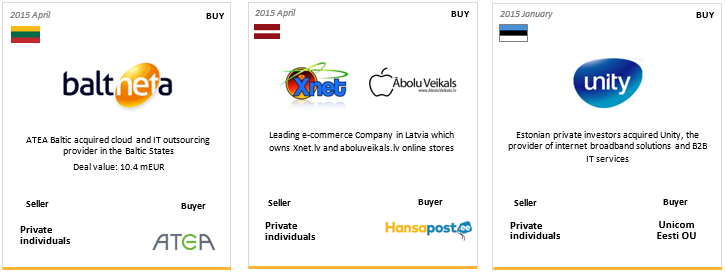

The most important transactions in TMT this year were the sale of controlling stake of Pigu.lt Group to MCI and acquisition of Baltnetos Komunikacijos by ATEA. In April, Polish private equity firm MCI signed agreement to acquire 51% shares of Pigu.lt, the largest e-commerce company in the Baltics. The deal value was not disclosed. Also in April, the leading regional IT infrastructure services provider ATEA acquired 100% ownership in cloud and IT outsourcing provider Baltneta Komunikacijos for consideration of 10.4 million EUR.

After the announcement of Cgates acquisition by East Capital at the end of 2014, Lithuanian cable TV and internet companies have to look for new development opportunities. In late April, another major Lithuanian cable TV provider Init announced the acquisition of its local peer Dokeda. In the coming period the market can expect even more activity in TMT sector. According to Lithuanian communications regulatory authority data, currently there are 107 internet service providers in Lithuania. Therefore, there are plenty of consolidation opportunities in the market. Rumours on possible sale of internet and television supplier “Kava” has already appeared in the press in early June. The long-awaited Mid Europa Partners exit from Lithuanian and Latvian mobile operator Bite is expected to kick-off in late summer and should bring Baltic telecoms market consolidation opportunities to the attention of leading strategic and private equity investors across Europe.

Growth financing is steadily available

Capital raise activity in technology ventures sector remained active in H1 2015. Developed IT infrastructure and transparent business environment encourages development of the start-ups ecosystem, the reason why Baltics are likely to see similar transaction activity to continue in the second half of 2015. Estonia leads by the number of successful financing rounds. In June, Skeleton Technologies, the manufacturer of high-performance ultracapacitors completed Series B financing of 9.8 million EUR from a consortium led by Nasdaq OMX listed Harju Elekter Group and private investment firm UP Invest. It’s also worth mentioning that in January first Baltic start-up, London headquartered cash transfer platform TransferWise reached 1 billion USD valuation by raising 58 million USD from US based venture firm Andreessen Horowitz.

Access to variety of capital solutions, for years a bottleneck for growth oriented Baltic enterprises has further opened in 2015. In our last report we referred to the rise of Baltic private equity industry with three new locally managed funds entering to the market. H1 2015 has seen increasing activity in mezzanine financing segment, Mezzanine Management being most active investor in the Baltics with two completed transactions (7 million EUR investment to Lithuanian refrigeration equipment manufacturer Freor in February and 23 million EUR mezzanine facility provided to Latvian car financing firm Mogo Finance in June). H1 2015 presented also some activity in typically silent capital markets when two Baltic companies (Estonian beverage industry supplier Linda Nektar and Lithuanian funeral services company K2 LT) debuted on Nasdaq First North.

Availability of different capital solutions, from private equity to subordinated debt, bonds and traditional bank loans, and financial sponsors competing for quality assets should encourage Baltic entrepreneurs to actively pursue market consolidation, international expansion and MBO opportunities. Baltic countries are among the smallest in Europe and many Baltic companies struggle to find domestic sources for further growth, therefore we see increasing need for well performing businesses to seek for acquisitive growth abroad. Bringing on board private equity firm could provide both financial strength as well as necessary experience in executing international roll-out. Management Buy-Out (MBO) type of transactions should also see increase in coming years as Baltic companies are facing generation switch and continuous departure of international corporates from the region provide unique opportunities for management teams to gain ownership stakes in strong companies

Keystone Advisers deal count – 9 transactions in 2015

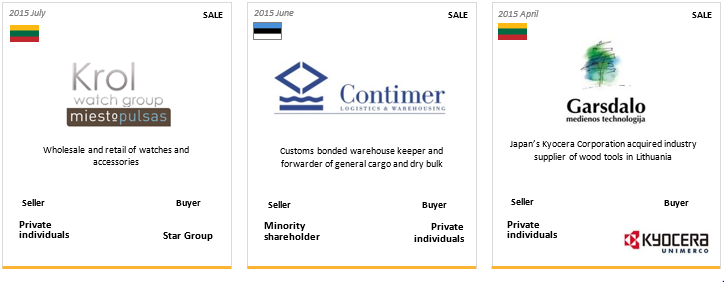

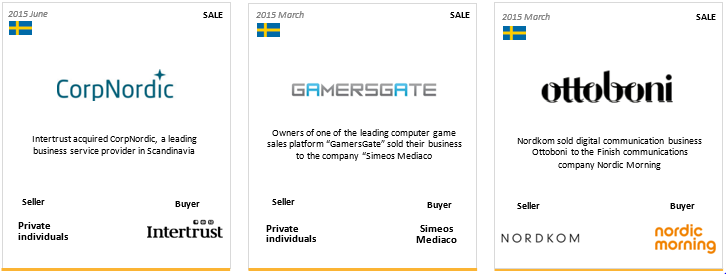

Year to date 2015 we have successfully completed 9 M&A deals: three in Lithuania and Sweden each, two in Estonia and one in Latvia.

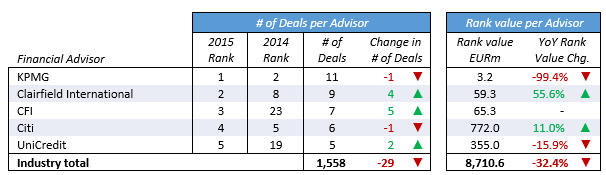

CFI Group leads CEE mid-market advisory tables by deal value

Keystone is a part of Corporate Finance International, a select group of investment banks with established cross-border capabilities and focus on middle market transactions, with an average deal size approximately EUR 10 million to EUR 200 million. Founded in 2006 to deliver best-in-class cross-border M&A services to the middle market, CFI delivers more than a decade of international collaboration among its members, including the successful delivery of over 300 cross-border deals with an aggregate EUR 19 billion of deal value since 2000.

In the first half of 2015, members of CFI Group have completed 7 deals in Eastern Europe (CEE region), ranked second by the number of deals among mid-market financial advisers (up to $200m).

About Keystone Advisers

An independent financial advisory firm providing investment banking services regarding M&A and capital raising situations. For many years we provide highest quality services to our customers based on our long-standing experience and high competence in the field. We have accumulated durable experience with providing various types of financial advisory. Since 2000, Keystone Advisers has successfully completed more than 150 transactions. A wide network of contacts and excellent project management skills ensures the highest quality service to our customers. For more information about our services please contact:

|

KAROLIS RŪKAS+37052487677 |