- Baltic M&A market showing increase in deal activity starting from second half of 2015

- Commercial real estate transactions emerged as the fastest growth segment

- Baltic region provides overlooked opportunities for European mid-market private equity

Bumpy road for Baltic M&A market

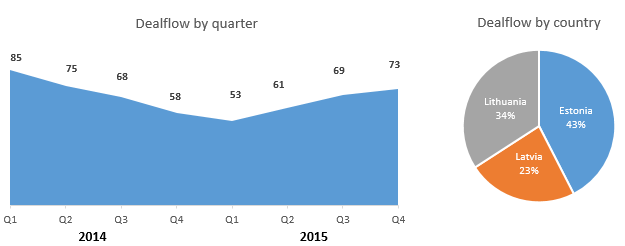

Keystone Advisers is releasing its second annual Baltic M&A Watch. Compared to year 2014 when the amount of closed transactions was decreasing each quarter and a number of sizeable transactions were cancelled on last minute, the year 2015 brought us reversing trend – after a slow start in the first quarter the market rebounded over the course of the year, resulting in 256 M&A transactions and various financing arrangements.

Total number of announced deals in 2015 was still down by 10.5% comparing to 2014. Keystone expects the actual deal number to be higher since transaction volume has been increasing by large in micro-cap’s and commercial real estate sector, where deals often close without any public announcement. We are in the process of collecting more comprehensive Balti M&A market data and expect to release updated market Watch soon.

Following trend of the last few years, Estonia has been the most active market, with 110 transaction announcements, which constitutes 43% of total deal volume in the region. 34% of Baltic transactions took place in Lithuania and remaining 23% in Latvia. Controversially sizeable transactions have more or less disappeared from Estonian market (excluding commercial real estate) and 2015 marks a strong rebound for Latvia where despite lower overall deal volume, the number of larger transactions have emerged.

Cross-border deal activity waiting for take-off

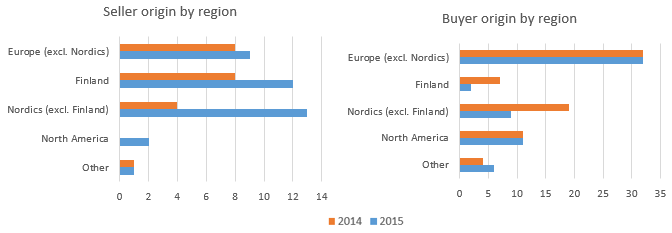

Foreign investors participated in 60 inbound deals, i.e. when acquiring company was from outside Baltics. This number is boosted by financial sponsors, mainly venture capital and real estate private equity investors who have been investing into promising Baltic based technology assets and yielding properties. Compared to previous years, 2015 has seen also increase in among foreign strategic investors eyeing the region due to favourable business environment and stable economic performance. The majority of foreign buyers originated from Europe and Nordics, accounting for 72% of transactions.

Among the sellers, foreign companies disposed assets in the Baltics in 37 transactions. Two-thirds of such deals involved sellers from the Nordics, with Finland at the top of the list with 12 transactions. This represents continuous trend where Finnish corporates are departing from the region either to focus on higher growth markets or to cash in earlier investments made to the Baltic companies post EU membership period. Buyers are typically local strategic competitors and increasingly management teams in MBO transactions.

Outbound deal activity has not improved much despite steadily available financing opportunities and fundamental need for Baltic companies to become more international and diversify their market risk. During 2015 Baltic companies completed only 13 acquisitions abroad (12 in 2014). The most notable transactions include acquisition of Swedish pet food producer Lantmännen Doggy by Lithuanian investment company NDX, acquisition of leading Danish ice-cream maker Premier Is by Latvian dairy group Food Union and 40% share acquisition of Danish logistics company Thermo-Transit by Lithuanian transportation company Girteka.

Most activity among small-caps

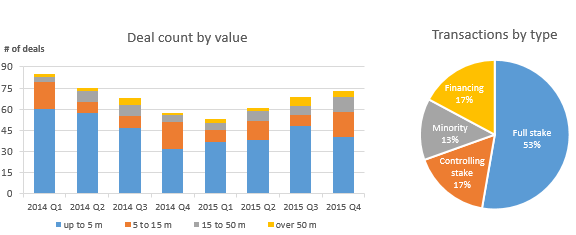

Contrary to global M&A market where megadeals and large corporate mergers have been making headlines, the Baltic deal volume concentrates to relatively small companies with transaction values under 5 million EUR. According to our estimates, only 16 transactions over 50 million EUR were completed during the year, up from 10 in 2014. 11 of these transactions were completed during the second half of the year and this might indicate that larger transactions are finally starting to return to the market.

In terms of ownership types, 70% of all deals involved transfer of either full or controlling stake. Financing transactions (equity and bond issues, venture capital investments and similar financing arrangements) accounted for 17% of total deal volume in 2015.

Last year’s largest M&A transaction with disclosed value was a merger of TeliaSonera’s Lithuanian subsidiaries Teo and Omnitel. Largest Lithuanian fixed line operator Teo acquired mobile operator Omnitel for EUR 220 million. This deal is the latest example of fixed-mobile convergence in telecommunications market. Other major transactions with disclosed values were:

- 199 million EUR acquisition of 43.25% stake of Ventspils Nafta, Latvian petroleum transportation and storage company, by Euromin in September;

- 163 million EUR acquisition of portfolio of commercial real estate in the Baltic states and Poland by Switzerland-based investment management company Partners Group.

Maturing commercial real estate market

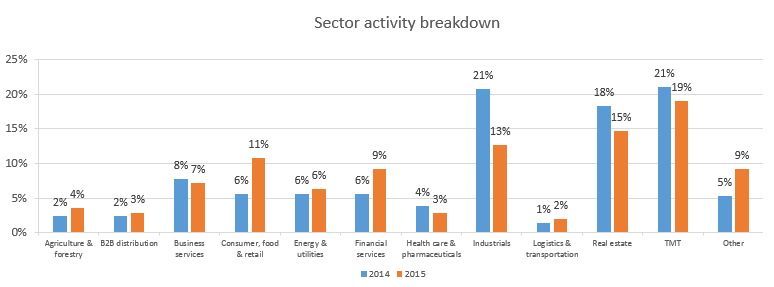

During 2015 technology, media and telecommunications (hereinafter- „TMT“) remained the most active sector, accounting for 19% of total deal count in 2015. As discussed in the previous issue of our newsletter, TMT sector was mostly driven by uprising start-up ecosystem in the Baltics and consolidation in telecommunications and technology sectors (for more information see the previous newsletter here). In addition to Omnitel deal, the highlight of the year for TMT was long-awaited sale of Lithuanian and Latvian telecoms group Bite to Providence Equity Partners, announced on the Christmas Eve.

Commercial real estate sector was the rising star of 2015 and generated at least 15% of Baltic deal volume. In Estonia and Latvia, deal activity in property sector was for years driven by local and mainly CIS based High Net Worth Individuals and few local asset managers such as Eften Capital and Colonna looking for stable investment heavens in yield generating real assets. Last year marked significant turn in terms of competition by entry of new international players such as Blackstone Real Estate Partners, Partners Group, American asset management firm LCN Capital Partners and French asset management firm Olympia Capital Group with its dedicated Baltic Opportunities Fund. As a result, average deal size in real estate sector grew visibly.

Eften Capital emerged as the most active pan-Baltic RE investor and completed 5 acquisitions worth 110 million EUR, including entrance to Lithuania with three acquisitions, all of them during the second half of the year. Even though supply of prime level commercial office is rather limited in the Baltics, the sector is expected to remain active in 2016. In addition to existing funds managed by foreign and local managers, a few companies recently announced set up of new funds, including Lords LB, Synergy Finance, United Asset Management, Novus Asset Management and others.

Other active sectors included industrials (13%), consumer food & retail (11%) and financial services (9%) sectors. Consumer, food & retail and financial sectors are expected to contribute more significantly to deal flow during coming years as these industries are first to feel pressure for further consolidation and several start-up companies, especially in fintech subsector are preparing for expansive international growth.

Outlook for 2016

Keystone expects Baltic M&A market to continue recovery in 2016 for several reasons. Rising cost base is forcing local companies to focus on efficiency and new markets. Baltic companies are often overcapitalized and have easy access to credit whereas organic growth in local market provides very limited growth opportunities. Baltic M&A market has remained very local by nature and is overlooked by corporates and international private equity. As a result, valuations remain lower compared to neighbouring Scandinavian countries and Poland.

In 2016, the market will likely be characterized by continued interest in TMT, real estate, consumer and industrial sectors. The market is also likely to see a number of disposals of private equity backed assets since managers like BaltCap, East Capital Explorer, Enterprise Investors, NCH Capital and several others are preparing to exit from their historical investments. Commercial real estate sector has all the possibilities to reach yet another all-time highs as established players are looking to spread their investment activity more steadily from Tallinn to Riga and Vilnius.

Another driving force for increasing M&A activity might be driven by long-awaited awakening of Baltic capital markets. Estonia has eased asset allocation rules for pension funds and this should channel more institutional money into local economies. Finally, there are talks about companies considering IPO’s in Baltic OMX and 2016 will likely see increasing number of Baltic corporates selling bonds to international capital markets. Estonian government is restructuring the management of state-owned assets and considers privatising some companies, postal services and logistics company Omniva being the most significant target under review.

European private equity has so far not been too active in Baltics, but this is likely to change as PE firms are seeking to spend record amounts of dry powder they have. Estonia, Latvia and Lithuania are often classified as yet another CEE country whereas economically Baltic economies are closer to Nordics, among the most crowded private equity markets in the world. Yet no Scandinavian PE firm has made any platform investment to Baltic headquartered companies for years. In this and previous reports we have commented increasing venture capital and private equity real estate activity in the Baltics, tendency that has not yet spread to small- and mid-cap private equity segments despite remarkably lower valuations available in the region. Keystone expects this discord to be noticed and eventually European mid-market PE will find their way to Baltics.

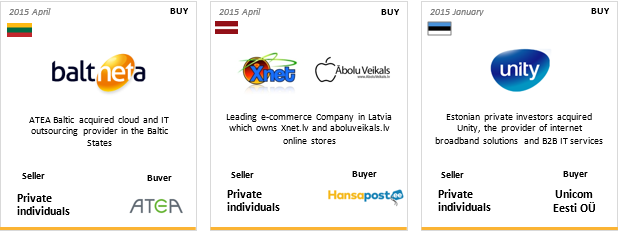

Keystone Advisers deal count – 13 transactions in 2015

During 2015 we have successfully completed 13 M&A deals: six in Sweden, three in Lithuania, three in Estonia and one in Latvia.

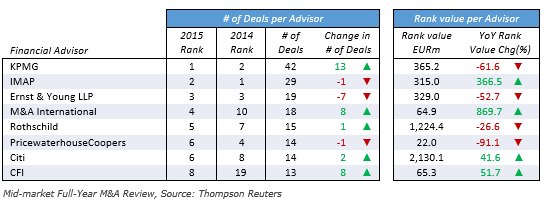

CFI Group leads Eastern Europe mid-market advisory tables

Keystone is a part of Corporate Finance International, a select group of investment banks with established cross-border capabilities and focus on middle market transactions, with an average deal size approximately EUR 10 million to EUR 200 million. Founded in 2006 to deliver best-in-class cross-border M&A services to the middle market, CFI delivers more than a decade of international collaboration among its members, including the successful delivery of over 300 cross-border deals with an aggregate EUR 19 billion of deal value since 2000.

In 2015, members of CFI Group have completed 13 deals in Eastern Europe, ranked eight by the number of deals among mid-market financial advisers (up to $500m). In Europe CFI ranked 14th among mid-market financial advisers (up to $500m) with 70 transactions during the year.

About Keystone Advisers

An independent financial advisory firm providing investment banking services regarding M&A and capital raising situations. For many years we provide highest quality services to our customers based on our long-standing experience and high competence in the field. We have accumulated durable experience with providing various types of financial advisory. Since 2000, Keystone Advisers has successfully completed more than 150 transactions. A wide network of contacts and excellent project management skills ensures the highest quality service to our customers. For more information about our services please contact:

New transaction – Maag Grupp bought debt claims of distressed Estonian dairy company Tere

/in /by martinKeystone Advisers acted as buy-side adviser to largest locally-owned Estonian food industry company Maag Grupp AS in purchase of debt claims of Tere AS and related companies from DNB and Nordea banks. Keystone transaction team consisted of Tõnis Kons and Henri Kaar.

For more information, click here.

New transaction – HeadHunter Group sells Baltics job classifieds business CV Keskus OÜ

/in /by martinHeadHunter Group, online HR-solutions leader operating in Russia, Ukraine, Belarus, Kazakhstan and other countries, divested 100% of the shares in CV Keskus OÜ, operator of leading job classifieds sites cvkeskus.ee in Estonia, cvmarket.lv in Latvia and cvmarket.lt in Lithuania to Ringier Axel Springer Media AG. HeadHunter will focus the resources on its core markets. Following the transaction, Ringier Axel Springer Media expanded to the Baltic classifieds market for the first time.

Keystone Advisers transaction team was led by Tõnis Kons and also included Stanislav Gutkevitsh and Martin Sillasoo.

For more information, click here

Keystone Baltic M&A Watch – 2015 overview

/in Uncategorized /by Vadim VladykinBumpy road for Baltic M&A market

Keystone Advisers is releasing its second annual Baltic M&A Watch. Compared to year 2014 when the amount of closed transactions was decreasing each quarter and a number of sizeable transactions were cancelled on last minute, the year 2015 brought us reversing trend – after a slow start in the first quarter the market rebounded over the course of the year, resulting in 256 M&A transactions and various financing arrangements.

Total number of announced deals in 2015 was still down by 10.5% comparing to 2014. Keystone expects the actual deal number to be higher since transaction volume has been increasing by large in micro-cap’s and commercial real estate sector, where deals often close without any public announcement. We are in the process of collecting more comprehensive Balti M&A market data and expect to release updated market Watch soon.

Following trend of the last few years, Estonia has been the most active market, with 110 transaction announcements, which constitutes 43% of total deal volume in the region. 34% of Baltic transactions took place in Lithuania and remaining 23% in Latvia. Controversially sizeable transactions have more or less disappeared from Estonian market (excluding commercial real estate) and 2015 marks a strong rebound for Latvia where despite lower overall deal volume, the number of larger transactions have emerged.

Cross-border deal activity waiting for take-off

Foreign investors participated in 60 inbound deals, i.e. when acquiring company was from outside Baltics. This number is boosted by financial sponsors, mainly venture capital and real estate private equity investors who have been investing into promising Baltic based technology assets and yielding properties. Compared to previous years, 2015 has seen also increase in among foreign strategic investors eyeing the region due to favourable business environment and stable economic performance. The majority of foreign buyers originated from Europe and Nordics, accounting for 72% of transactions.

Among the sellers, foreign companies disposed assets in the Baltics in 37 transactions. Two-thirds of such deals involved sellers from the Nordics, with Finland at the top of the list with 12 transactions. This represents continuous trend where Finnish corporates are departing from the region either to focus on higher growth markets or to cash in earlier investments made to the Baltic companies post EU membership period. Buyers are typically local strategic competitors and increasingly management teams in MBO transactions.

Outbound deal activity has not improved much despite steadily available financing opportunities and fundamental need for Baltic companies to become more international and diversify their market risk. During 2015 Baltic companies completed only 13 acquisitions abroad (12 in 2014). The most notable transactions include acquisition of Swedish pet food producer Lantmännen Doggy by Lithuanian investment company NDX, acquisition of leading Danish ice-cream maker Premier Is by Latvian dairy group Food Union and 40% share acquisition of Danish logistics company Thermo-Transit by Lithuanian transportation company Girteka.

Most activity among small-caps

Contrary to global M&A market where megadeals and large corporate mergers have been making headlines, the Baltic deal volume concentrates to relatively small companies with transaction values under 5 million EUR. According to our estimates, only 16 transactions over 50 million EUR were completed during the year, up from 10 in 2014. 11 of these transactions were completed during the second half of the year and this might indicate that larger transactions are finally starting to return to the market.

In terms of ownership types, 70% of all deals involved transfer of either full or controlling stake. Financing transactions (equity and bond issues, venture capital investments and similar financing arrangements) accounted for 17% of total deal volume in 2015.

Last year’s largest M&A transaction with disclosed value was a merger of TeliaSonera’s Lithuanian subsidiaries Teo and Omnitel. Largest Lithuanian fixed line operator Teo acquired mobile operator Omnitel for EUR 220 million. This deal is the latest example of fixed-mobile convergence in telecommunications market. Other major transactions with disclosed values were:

Maturing commercial real estate market

During 2015 technology, media and telecommunications (hereinafter- „TMT“) remained the most active sector, accounting for 19% of total deal count in 2015. As discussed in the previous issue of our newsletter, TMT sector was mostly driven by uprising start-up ecosystem in the Baltics and consolidation in telecommunications and technology sectors (for more information see the previous newsletter here). In addition to Omnitel deal, the highlight of the year for TMT was long-awaited sale of Lithuanian and Latvian telecoms group Bite to Providence Equity Partners, announced on the Christmas Eve.

Commercial real estate sector was the rising star of 2015 and generated at least 15% of Baltic deal volume. In Estonia and Latvia, deal activity in property sector was for years driven by local and mainly CIS based High Net Worth Individuals and few local asset managers such as Eften Capital and Colonna looking for stable investment heavens in yield generating real assets. Last year marked significant turn in terms of competition by entry of new international players such as Blackstone Real Estate Partners, Partners Group, American asset management firm LCN Capital Partners and French asset management firm Olympia Capital Group with its dedicated Baltic Opportunities Fund. As a result, average deal size in real estate sector grew visibly.

Eften Capital emerged as the most active pan-Baltic RE investor and completed 5 acquisitions worth 110 million EUR, including entrance to Lithuania with three acquisitions, all of them during the second half of the year. Even though supply of prime level commercial office is rather limited in the Baltics, the sector is expected to remain active in 2016. In addition to existing funds managed by foreign and local managers, a few companies recently announced set up of new funds, including Lords LB, Synergy Finance, United Asset Management, Novus Asset Management and others.

Other active sectors included industrials (13%), consumer food & retail (11%) and financial services (9%) sectors. Consumer, food & retail and financial sectors are expected to contribute more significantly to deal flow during coming years as these industries are first to feel pressure for further consolidation and several start-up companies, especially in fintech subsector are preparing for expansive international growth.

Outlook for 2016

Keystone expects Baltic M&A market to continue recovery in 2016 for several reasons. Rising cost base is forcing local companies to focus on efficiency and new markets. Baltic companies are often overcapitalized and have easy access to credit whereas organic growth in local market provides very limited growth opportunities. Baltic M&A market has remained very local by nature and is overlooked by corporates and international private equity. As a result, valuations remain lower compared to neighbouring Scandinavian countries and Poland.

In 2016, the market will likely be characterized by continued interest in TMT, real estate, consumer and industrial sectors. The market is also likely to see a number of disposals of private equity backed assets since managers like BaltCap, East Capital Explorer, Enterprise Investors, NCH Capital and several others are preparing to exit from their historical investments. Commercial real estate sector has all the possibilities to reach yet another all-time highs as established players are looking to spread their investment activity more steadily from Tallinn to Riga and Vilnius.

Another driving force for increasing M&A activity might be driven by long-awaited awakening of Baltic capital markets. Estonia has eased asset allocation rules for pension funds and this should channel more institutional money into local economies. Finally, there are talks about companies considering IPO’s in Baltic OMX and 2016 will likely see increasing number of Baltic corporates selling bonds to international capital markets. Estonian government is restructuring the management of state-owned assets and considers privatising some companies, postal services and logistics company Omniva being the most significant target under review.

European private equity has so far not been too active in Baltics, but this is likely to change as PE firms are seeking to spend record amounts of dry powder they have. Estonia, Latvia and Lithuania are often classified as yet another CEE country whereas economically Baltic economies are closer to Nordics, among the most crowded private equity markets in the world. Yet no Scandinavian PE firm has made any platform investment to Baltic headquartered companies for years. In this and previous reports we have commented increasing venture capital and private equity real estate activity in the Baltics, tendency that has not yet spread to small- and mid-cap private equity segments despite remarkably lower valuations available in the region. Keystone expects this discord to be noticed and eventually European mid-market PE will find their way to Baltics.

Keystone Advisers deal count – 13 transactions in 2015

During 2015 we have successfully completed 13 M&A deals: six in Sweden, three in Lithuania, three in Estonia and one in Latvia.

CFI Group leads Eastern Europe mid-market advisory tables

Keystone is a part of Corporate Finance International, a select group of investment banks with established cross-border capabilities and focus on middle market transactions, with an average deal size approximately EUR 10 million to EUR 200 million. Founded in 2006 to deliver best-in-class cross-border M&A services to the middle market, CFI delivers more than a decade of international collaboration among its members, including the successful delivery of over 300 cross-border deals with an aggregate EUR 19 billion of deal value since 2000.

In 2015, members of CFI Group have completed 13 deals in Eastern Europe, ranked eight by the number of deals among mid-market financial advisers (up to $500m). In Europe CFI ranked 14th among mid-market financial advisers (up to $500m) with 70 transactions during the year.

About Keystone Advisers

An independent financial advisory firm providing investment banking services regarding M&A and capital raising situations. For many years we provide highest quality services to our customers based on our long-standing experience and high competence in the field. We have accumulated durable experience with providing various types of financial advisory. Since 2000, Keystone Advisers has successfully completed more than 150 transactions. A wide network of contacts and excellent project management skills ensures the highest quality service to our customers. For more information about our services please contact:

TÕNIS

KONS

+3725015640

Send Email

Keystone Baltic M&A Watch – 2015 H1 overview

/in /by Artjoms KorolsMain highlights

The market remains active

After a considerable increase in 2014, the number of M&A transactions in the Baltic States has decreased in the first half of 2015, however, the market remained active. According to Keystone Baltic M&A Watch data, in H1 2015 there were 121 M&A transactions in the Baltic States, compared to 161 transactions in H1 2014.

According to the target company‘s geographic location, 36% of all transactions were in Estonia, 27% in Lithuania, 21% in Latvia and 19% in other countries (i.e. Baltic companies acquired entities abroad or Baltic companies were part of transaction covering several geographies). According to our estimates, two-thirds of the M&A activity appeared among the micro-caps, meaning transaction values under 5 million EUR and mostly domestic deals.

Among the largest transactions with disclosed values it’s worth mentioning:

Market situation encourages consolidation

In H1 2015 trends in the Baltic market remained similar as last year. Main activity was observed in technology, media and telecommunications (hereinafter- „TMT“) with every fifth deal happening in this sector.

The most important transactions in TMT this year were the sale of controlling stake of Pigu.lt Group to MCI and acquisition of Baltnetos Komunikacijos by ATEA. In April, Polish private equity firm MCI signed agreement to acquire 51% shares of Pigu.lt, the largest e-commerce company in the Baltics. The deal value was not disclosed. Also in April, the leading regional IT infrastructure services provider ATEA acquired 100% ownership in cloud and IT outsourcing provider Baltneta Komunikacijos for consideration of 10.4 million EUR.

After the announcement of Cgates acquisition by East Capital at the end of 2014, Lithuanian cable TV and internet companies have to look for new development opportunities. In late April, another major Lithuanian cable TV provider Init announced the acquisition of its local peer Dokeda. In the coming period the market can expect even more activity in TMT sector. According to Lithuanian communications regulatory authority data, currently there are 107 internet service providers in Lithuania. Therefore, there are plenty of consolidation opportunities in the market. Rumours on possible sale of internet and television supplier “Kava” has already appeared in the press in early June. The long-awaited Mid Europa Partners exit from Lithuanian and Latvian mobile operator Bite is expected to kick-off in late summer and should bring Baltic telecoms market consolidation opportunities to the attention of leading strategic and private equity investors across Europe.

Growth financing is steadily available

Capital raise activity in technology ventures sector remained active in H1 2015. Developed IT infrastructure and transparent business environment encourages development of the start-ups ecosystem, the reason why Baltics are likely to see similar transaction activity to continue in the second half of 2015. Estonia leads by the number of successful financing rounds. In June, Skeleton Technologies, the manufacturer of high-performance ultracapacitors completed Series B financing of 9.8 million EUR from a consortium led by Nasdaq OMX listed Harju Elekter Group and private investment firm UP Invest. It’s also worth mentioning that in January first Baltic start-up, London headquartered cash transfer platform TransferWise reached 1 billion USD valuation by raising 58 million USD from US based venture firm Andreessen Horowitz.

Access to variety of capital solutions, for years a bottleneck for growth oriented Baltic enterprises has further opened in 2015. In our last report we referred to the rise of Baltic private equity industry with three new locally managed funds entering to the market. H1 2015 has seen increasing activity in mezzanine financing segment, Mezzanine Management being most active investor in the Baltics with two completed transactions (7 million EUR investment to Lithuanian refrigeration equipment manufacturer Freor in February and 23 million EUR mezzanine facility provided to Latvian car financing firm Mogo Finance in June). H1 2015 presented also some activity in typically silent capital markets when two Baltic companies (Estonian beverage industry supplier Linda Nektar and Lithuanian funeral services company K2 LT) debuted on Nasdaq First North.

Availability of different capital solutions, from private equity to subordinated debt, bonds and traditional bank loans, and financial sponsors competing for quality assets should encourage Baltic entrepreneurs to actively pursue market consolidation, international expansion and MBO opportunities. Baltic countries are among the smallest in Europe and many Baltic companies struggle to find domestic sources for further growth, therefore we see increasing need for well performing businesses to seek for acquisitive growth abroad. Bringing on board private equity firm could provide both financial strength as well as necessary experience in executing international roll-out. Management Buy-Out (MBO) type of transactions should also see increase in coming years as Baltic companies are facing generation switch and continuous departure of international corporates from the region provide unique opportunities for management teams to gain ownership stakes in strong companies

Keystone Advisers deal count – 9 transactions in 2015

Year to date 2015 we have successfully completed 9 M&A deals: three in Lithuania and Sweden each, two in Estonia and one in Latvia.

CFI Group leads CEE mid-market advisory tables by deal value

Keystone is a part of Corporate Finance International, a select group of investment banks with established cross-border capabilities and focus on middle market transactions, with an average deal size approximately EUR 10 million to EUR 200 million. Founded in 2006 to deliver best-in-class cross-border M&A services to the middle market, CFI delivers more than a decade of international collaboration among its members, including the successful delivery of over 300 cross-border deals with an aggregate EUR 19 billion of deal value since 2000.

In the first half of 2015, members of CFI Group have completed 7 deals in Eastern Europe (CEE region), ranked second by the number of deals among mid-market financial advisers (up to $200m).

Source: Thompson Reuters

About Keystone Advisers

An independent financial advisory firm providing investment banking services regarding M&A and capital raising situations. For many years we provide highest quality services to our customers based on our long-standing experience and high competence in the field. We have accumulated durable experience with providing various types of financial advisory. Since 2000, Keystone Advisers has successfully completed more than 150 transactions. A wide network of contacts and excellent project management skills ensures the highest quality service to our customers. For more information about our services please contact:

KAROLIS RŪKAS

+37052487677

Send Email

New transaction: The minority shareholder and one of the founders of Contimer, an Estonian logistics provider, sold his shares

/in /by Artjoms KorolsOne of the founders and minority shareholder of Contimer sold his shares in the company

In June 2015 our client signed an agreement to sell 27.5% stake in Contimer OÜ.

Contimer is among the top three customs bonded warehouse keepers and forwarders of general cargo and dry bulk in Estonia. The company was founded in 1995 and its turnover reached EUR 15.2 mn in 2013.

The transaction was completed on 18 June 2015. Transaction value is not disclosed. Keystone Advisers acted as the exclusive financial advisor to the Seller.

For additional information please contact:

TÕNIS KONS

+372 501 5640

Send Email

New transaction: Sale of Garsdalo Medienos Technologija

/in Tehingud /by Vadim VladykinGarsdalo Medienos Technologija, specialized tools and equipment provider for the woodworking industry, is acquired by Kyocera Unimerco

Kyocera Group’s subsidiary in charge of manufacturing and sales of industrial cutting tools, Kyocera Unimerco A/S has entered into agreement to acquire 100% shares in UAB Garsdalo Medienos Technologija (hereinafter – “Garsdalo”), a Lithuania-based company specializing in production and distribution of tools and equipment for the woodworking industry. Through this acquisition, Kyocera Unimerco aims to strengthen its woodworking tool business currently centered in Northern Europe.

Founded in 1998 in Lithuania, Garsdalo specializes in production of polycrystalline diamond (PCD) tools, providing re-sharpening services and distributing tools and equipment for the woodworking industry. The 42 people company has a state of the art production plant in Vilnius and is exporting tools to more than 10 countries in Europe.

“I am glad that we have reached an agreement with our long-term partner – we have been working with Kyocera Unimerco since the foundation of the company in 1998. Being a part of the larger group now means further development of Garsdalo as a leading woodworking tool supplier in the region as well as new opportunities for our customers”, says Ole Garsdal, founder and CEO of Garsdalo.

According to Anders Hegaard, Group Vice President at Kyocera Unimerco, “We are happy to welcome Garsdalo into our group. This acquisition will allow us to create synergies by expanding sales channels in Central and Eastern Europe and strengthening our product line-up”.

This is Kyocera Unimerco’s first acquisition in Eastern Europe. The transaction was completed on 27 April 2015. Transaction value is not disclosed.

Keystone Advisers acted as the exclusive financial advisor to the Seller. Seller’s legal advisor was Glimstedt. Kyocera Unimerco was advised by KPMG, Plesner and LAWIN.

About Kyocera Unimerco group

Kyocera Unimerco A/S is an international manufacturer, distributor and service company. The company comprises a tooling division (Kyocera Unimerco Tooling) and a fastening division (Kyocera Unimerco Fastening). The group was founded in Denmark in 1964 under the name Unimerco. In 2011, all activities were acquired by Kyocera Group’s Germany-based subsidiary Kyocera Fineceramics GmbH.

Kyocera Corporation (NYSE:KYO) (TOKYO:6971), the parent and global headquarters of the Kyocera Group, was founded in 1959 as a producer of fine ceramics. By combining these engineered materials with metals and integrating them with other technologies, Kyocera has become a leading supplier of electronic components, printers, copiers, solar power generating systems, mobile phones, semiconductor packages, cutting tools and industrial ceramics. During the year ended March 31, 2014, the company’s net sales totalled 1.45 trillion yen (approx. USD14.1 billion). Kyocera appears on the latest listing of the “Top 100 Global Innovators” by Thomson Reuters, and is ranked #531 on Forbes magazine’s current “Global 2000” listing of the world’s largest publicly traded companies.

For more information please contact:

KAROLIS RŪKAS

+37052487677

Send Email

New Keystone Advisers transaction: Acquisition of Baltnetos Komunikacijos

/in /by Vadim VladykinAtea Baltic acquired 100% of Lithuanian cloud and outsourcing provider Baltnetos Komunikacijos

Atea Baltic, subsidiary of Norwegian IT group Atea ASA, acquired Baltnetos Komunikacijos, leading Lithuanian cloud and IT outsourcing provider. Baltnetos Komunikacijos, founded in 1996 and headquartered in Vilnius, offers data center, cloud computing, internet, VoIP and IT maintenance. The company has about 120 employees, and recorded €7.2 mln sales and €1.9 mln EBITDA in 2014.

Atea ASA is one of the leading suppliers of IT services in Scandinavia and Baltics. In the Baltics the company has more than 500 employees and sales in 2014 reached €94.7 mln. During past few years Atea made 5 other acquisitions in the Baltics within the IT sector.

The transaction was completed on 9 April 2015. The agreed enterprise value is €10.4 mln. Keystone acted as an advisor to Atea Baltic.

For more information please see the press release or contact:

KAROLIS RŪKAS

+37052487677

Send Email

New transaction: Hansapost acquires majority stake in the Latvian e-commerce firm Xnet.lv

/in /by Vadim VladykinLeading Estonian e-commerce firm Hansapost acquired company in Latvia

In April 2015 Hansapost OÜ signed an agreement to acquire a 70.5% majority stake in SIA “Xnet”.

Xnet is one of the leading e-commerce businesses in Latvia operating Xnet.lv, a popular online department store, and aboluveikals.lv, the first official online retailer of Apple products in Latvia. Company’s turnover reached EUR 4 mn last year. Hansapost is the largest e-commerce company in Estonia with turnover exceeding EUR 10 mn.

For additional information please contact:

TÕNIS KONS

+3725015640

Send Email

New transaction: Acquisition of Unity Systems and Unity Internet

/in /by Stanislav GutkevitshUnitcom Eesti acquired Unity Internet and Unity Systems

Unitcom Eesti, a special purpose vehicle (SPV) owned by a group of Estonian private investors, acquired Unity Internet, a wireless broadband access provider, and Unity Systems, an enterprise IT infrastructure services provider.

Keystone advised the owners of Unitcom Eesti OÜ in the process of acquisition of Estonian firms Unity Systems and Unity Internet.

Unity Internet is a wireless broadband access services provider with ca 40% country coverage, incl. capital Tallinn and the surrounding Harju county. Established in 2004, the company has focused primarily on private and business customers outside the network coverage of large telecoms. Unity Systems has been offering IT infrastructure maintenance and development services as well as IT hardware and software sales to business clients in Northern Estonia since 1998. Among other engagements, Unity Systems provides technical maintenance also to the electronic ticket system of Tallinn public transport.

Net revenue of the acquired companies in 2013 amounted to EUR 1.37m and EBITDA EUR 0.23m. The transaction price is kept undisclosed. The transaction was advised by investment bank Keystone Advisers, law firm Everheds Ots & Co, and financial advisory Grant Thornton Rimess. Transaction financing was provided by Swedbank Estonia.

For more information, please read the press release or contact us:

TÕNIS KONS

+3725015640

Send Email

PRESS RELEASE

Unitcom Eesti, a special purpose vehicle (SPV) owned by a group of Estonian private investors, acquired Unity Internet, a wireless broadband access provider, and Unity Systems, an enterprise IT infrastructure services provider.

With the transaction that reached closing on January 13, a group of Estonian private investors with telecom, IT and cable television background acquired 100 percent shareholdings in Unity Internet and Unity Systems. Both companies were controlled by Herty Tammo, a serial entrepreneur with interests in various startups and industrial businesses. Management as minority shareholders rolled their equity over to the acquiring company.

Unity Internet is a wireless broadband access services provider with ca 40% country coverage, incl. capital Tallinn and the surrounding Harju county. Established in 2004, the company has focused primarily on private and business customers outside the network coverage of large telecoms. Unity Systems has been offering IT infrastructure maintenance and development services as well as IT hardware and software sales to business clients in Northern Estonia since 1998. Among other engagements, Unity Systems provides technical maintenance also to the electronic ticket system of Tallinn public transport.

Net revenue of the acquired companies in 2013 amounted to EUR 1.37m and EBITDA EUR 0.23m. The transaction price is kept undisclosed. The transaction was advised by investment bank Keystone Advisers, law firm Everheds Ots & Co, and financial advisory Grant Thornton Rimess. Transaction financing was provided by Swedbank Estonia.

Additional information:

Peep Põldsamm, Unitcom Eesti / Keystone Advisers

Mobile: +372 545 10100

E-mail: peep.poldsamm@keystoneadvisers.ee

Herty Tammo, T-Ventures AS / OÜ HT Management

Mobile: +372 51 11357

E-mail: herty@tammo.ee

Keystone Baltic M&A Watch, Q1-Q3 2014

/in Transactions, Transactions, Transactions, Transactions, Transactions, Transactions, Transactions, Transactions /by Stanislav GutkevitshYear 2014 sees a continued gradual increase in M&A activity

Following a significant slowdown during the crisis years, M&A activity has gradually increased since the start of 2013. Sale of distressed assets is being replaced by deals that were put on hold during the crisis, as profitability returns to normal levels. Lengthy one to one negotiations have been replaced by sales processes with multiple bidders. Foreign bidders have resumed to take interest in Baltic companies; however most buyers are still local companies.

Overall, the first three quarters of 2014 have seen 201 transactions, more than 20% increase compared to 163 deals made during the same period in 2013. The deal flow was highest in the first quarter with 83 deals, slowing down to 74 and 58 deals in Q2 and Q3, respectively.

Based on deal value, Baltic deals, Jan-Sep 2014, Source: Keystone Watch

Yet, looking at the deal value structure, a more nuanced picture emerges. The vast majority of the deals were low value transactions with deal value not exceeding 5 million EUR. However, while more than half of the deals in the range between 5 and 15 million EUR in value took place in Q1, the situation is exact opposite for the deals above 15 million in value. There were 3 such deals in Q1, and 10 and 11 deals in Q2 and Q3, respectively.

Based on the country of the deal target, Jan-Sep 2014, Source: Keystone Watch

Almost half of deals made in Estonia, while larger transactions taking place in Latvia

Estonia is the clear leader among the Baltic countries in terms of deal flow – 84 deals or nearly half of all the deals in the Baltics targeted an Estonian-based company. Nevertheless, the more sizable deals, i.e. those worth 5 million EUR and above, are split roughly equally among the Baltic states with no clear leader. Yet, with respect to the big deals (worth above 50 million EUR), Latvia took the lion’s share with 4 deals, while there were 2 such deals in Lithuania and only 1 in Estonia.

To highlight the major deals, sale of RSA Insurance Group’s Baltic operations to Polish giant PZU for 364 million EUR was the largest deal in the Baltics so far this year. Gazprom’s exit from Lithuanian gas companies and the sale of the insolvent Latvian steelmaker Liepajas Metalurgs to Ukrainian KVV Group complete the top 3 deals in the period.

Looking at the statistics of participating parties, the number of deals is split roughly equally between intra-Baltic transactions and those that involved a country from outside the Baltics.

Based on type of the deal, Baltic countries, Jan-Sep 2014, Source: Keystone Watch

TMT, Industrials and Commercial Real Estate are the most active industries in terms of M&A

The most deals were taking place in TMT, Industrials and Commercial Real Estate sectors, which together made up 60% of total deal flow in the Baltics. TMT sector is particularly interesting as there is a substantial amount of deals involving IT start-ups, especially in Estonia. The most noteworthy deals were the sale of Estonian-established community engineering platform GrabCAD to global 3D printing leader Stratasys and Latvia’s social networking platform Ask.fm’s sale to Ask.com.

Based on the industry of the target, Baltic countries, Jan-Sep 2014, Source: Keystone Watch

Baltic economies are forecast to be among the fastest growing EU members in 2015

Looking into the future, according to the European Commission forecasts, Baltic economies are going to be among the fastest growing EU members in 2015. With Latvia and Lithuania expected to grow at around 3% and Estonia at 2%.

The positive macroeconomic outlook is expected to continue supporting the already strong business confidence, good growth opportunities and credit availability. Besides increasing the attractiveness of local companies as acquisition targets, relatively good growth prospects also put them in a strong position to make acquisitions themselves. This process is enhanced by the fact that banks are willing to issue secured loan credit at relatively cheap rates. The local banking sector is dominated by the subsidiaries of Nordic banks, which are strong at home and hold favorable view of the Baltic market.

Baltic region enjoys increasing private equity interest

Keystone Baltic M&A Watch indicates increasing private equity activity in the region. Three quarters of 2014 have seen a total of 80 deals with financial investor involvement, 40% of all transactions counted by Keystone. One third of deal flow comes from venture capital segment as seed and growth financing opportunities for fast growing Baltic technology companies have become steadily available. Locally managed VC vehicles are accompanied by global growth investors such as Accel Partners, Intel Capital and Bain Capital Ventures that have all invested in the Baltic based tech ventures.

Buy-out and growth financing segments are relatively immature compared to venture financing opportunities; still, a trend towards increasing activity could be noticed. European Investment Fund backed fund-of-funds vehicle is expected to bring approximately 300 million EUR of new capital to the market and at least five local General Partner teams have taken up the management of that capital. Thus far, however, only BaltCap has managed to reach closing with their new mid-market fund. BaltCap is clearly the most active PE investor in the region by Keystone Baltic 2014 M&A Watch, followed by Eften Capital and East Capital in commercial property sectors.

Baltic countries are now rarely defined as emerging markets and this reflects to private equity market as well. Some corporates and emerging market focused high-growth funds that invested in the Baltic-based companies ten years ago are now selling their portfolio holdings (for example Askembla, Amber Trust) and these assets are often picked up by local entrepreneurs and private investment companies such as UP Invest and My Invest.

Keystone expects the abovementioned trends to continue in 2015 and onwards. Valuations in the Baltic region are significantly lower compared to neighbouring Scandinavian or Western European markets and an increasing number of growth oriented Baltic enterprises are looking to raise equity or mezzanine financing to support their expansion outside the region. Baltic markets are now clearly on the radar for pan-European private equity community.

For more information please contact Mr Tõnis Kons:

TÕNIS

KONS

+3725015640

Send Email