Keystone Baltic M&A Watch – 2015 overview

- Baltic M&A market showing increase in deal activity starting from second half of 2015

- Commercial real estate transactions emerged as the fastest growth segment

- Baltic region provides overlooked opportunities for European mid-market private equity

Bumpy road for Baltic M&A market

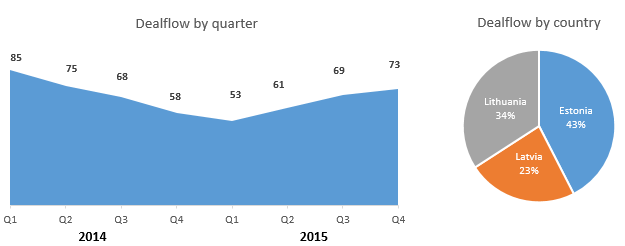

Keystone Advisers is releasing its second annual Baltic M&A Watch. Compared to year 2014 when the amount of closed transactions was decreasing each quarter and a number of sizeable transactions were cancelled on last minute, the year 2015 brought us reversing trend – after a slow start in the first quarter the market rebounded over the course of the year, resulting in 256 M&A transactions and various financing arrangements.

Total number of announced deals in 2015 was still down by 10.5% comparing to 2014. Keystone expects the actual deal number to be higher since transaction volume has been increasing by large in micro-cap’s and commercial real estate sector, where deals often close without any public announcement. We are in the process of collecting more comprehensive Balti M&A market data and expect to release updated market Watch soon.

Following trend of the last few years, Estonia has been the most active market, with 110 transaction announcements, which constitutes 43% of total deal volume in the region. 34% of Baltic transactions took place in Lithuania and remaining 23% in Latvia. Controversially sizeable transactions have more or less disappeared from Estonian market (excluding commercial real estate) and 2015 marks a strong rebound for Latvia where despite lower overall deal volume, the number of larger transactions have emerged.

Cross-border deal activity waiting for take-off

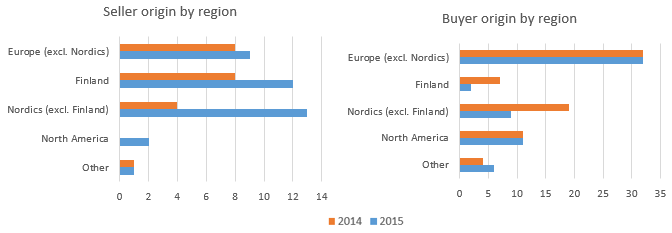

Foreign investors participated in 60 inbound deals, i.e. when acquiring company was from outside Baltics. This number is boosted by financial sponsors, mainly venture capital and real estate private equity investors who have been investing into promising Baltic based technology assets and yielding properties. Compared to previous years, 2015 has seen also increase in among foreign strategic investors eyeing the region due to favourable business environment and stable economic performance. The majority of foreign buyers originated from Europe and Nordics, accounting for 72% of transactions.

Among the sellers, foreign companies disposed assets in the Baltics in 37 transactions. Two-thirds of such deals involved sellers from the Nordics, with Finland at the top of the list with 12 transactions. This represents continuous trend where Finnish corporates are departing from the region either to focus on higher growth markets or to cash in earlier investments made to the Baltic companies post EU membership period. Buyers are typically local strategic competitors and increasingly management teams in MBO transactions.

Outbound deal activity has not improved much despite steadily available financing opportunities and fundamental need for Baltic companies to become more international and diversify their market risk. During 2015 Baltic companies completed only 13 acquisitions abroad (12 in 2014). The most notable transactions include acquisition of Swedish pet food producer Lantmännen Doggy by Lithuanian investment company NDX, acquisition of leading Danish ice-cream maker Premier Is by Latvian dairy group Food Union and 40% share acquisition of Danish logistics company Thermo-Transit by Lithuanian transportation company Girteka.

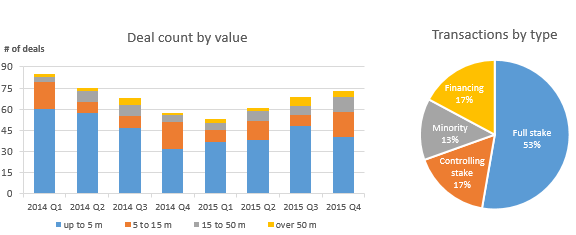

Most activity among small-caps

Contrary to global M&A market where megadeals and large corporate mergers have been making headlines, the Baltic deal volume concentrates to relatively small companies with transaction values under 5 million EUR. According to our estimates, only 16 transactions over 50 million EUR were completed during the year, up from 10 in 2014. 11 of these transactions were completed during the second half of the year and this might indicate that larger transactions are finally starting to return to the market.

In terms of ownership types, 70% of all deals involved transfer of either full or controlling stake. Financing transactions (equity and bond issues, venture capital investments and similar financing arrangements) accounted for 17% of total deal volume in 2015.

Last year’s largest M&A transaction with disclosed value was a merger of TeliaSonera’s Lithuanian subsidiaries Teo and Omnitel. Largest Lithuanian fixed line operator Teo acquired mobile operator Omnitel for EUR 220 million. This deal is the latest example of fixed-mobile convergence in telecommunications market. Other major transactions with disclosed values were:

- 199 million EUR acquisition of 43.25% stake of Ventspils Nafta, Latvian petroleum transportation and storage company, by Euromin in September;

- 163 million EUR acquisition of portfolio of commercial real estate in the Baltic states and Poland by Switzerland-based investment management company Partners Group.

Maturing commercial real estate market

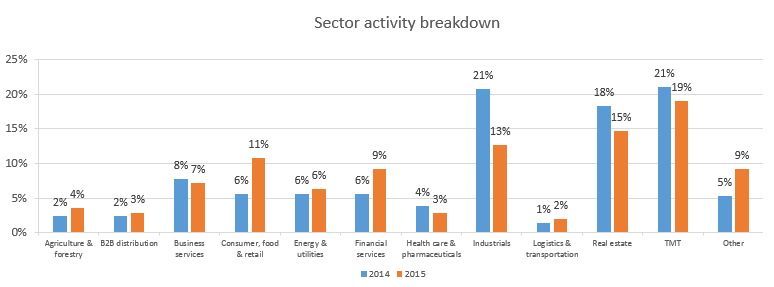

During 2015 technology, media and telecommunications (hereinafter- „TMT“) remained the most active sector, accounting for 19% of total deal count in 2015. As discussed in the previous issue of our newsletter, TMT sector was mostly driven by uprising start-up ecosystem in the Baltics and consolidation in telecommunications and technology sectors (for more information see the previous newsletter here). In addition to Omnitel deal, the highlight of the year for TMT was long-awaited sale of Lithuanian and Latvian telecoms group Bite to Providence Equity Partners, announced on the Christmas Eve.

Commercial real estate sector was the rising star of 2015 and generated at least 15% of Baltic deal volume. In Estonia and Latvia, deal activity in property sector was for years driven by local and mainly CIS based High Net Worth Individuals and few local asset managers such as Eften Capital and Colonna looking for stable investment heavens in yield generating real assets. Last year marked significant turn in terms of competition by entry of new international players such as Blackstone Real Estate Partners, Partners Group, American asset management firm LCN Capital Partners and French asset management firm Olympia Capital Group with its dedicated Baltic Opportunities Fund. As a result, average deal size in real estate sector grew visibly.

Eften Capital emerged as the most active pan-Baltic RE investor and completed 5 acquisitions worth 110 million EUR, including entrance to Lithuania with three acquisitions, all of them during the second half of the year. Even though supply of prime level commercial office is rather limited in the Baltics, the sector is expected to remain active in 2016. In addition to existing funds managed by foreign and local managers, a few companies recently announced set up of new funds, including Lords LB, Synergy Finance, United Asset Management, Novus Asset Management and others.

Other active sectors included industrials (13%), consumer food & retail (11%) and financial services (9%) sectors. Consumer, food & retail and financial sectors are expected to contribute more significantly to deal flow during coming years as these industries are first to feel pressure for further consolidation and several start-up companies, especially in fintech subsector are preparing for expansive international growth.

Outlook for 2016

Keystone expects Baltic M&A market to continue recovery in 2016 for several reasons. Rising cost base is forcing local companies to focus on efficiency and new markets. Baltic companies are often overcapitalized and have easy access to credit whereas organic growth in local market provides very limited growth opportunities. Baltic M&A market has remained very local by nature and is overlooked by corporates and international private equity. As a result, valuations remain lower compared to neighbouring Scandinavian countries and Poland.

In 2016, the market will likely be characterized by continued interest in TMT, real estate, consumer and industrial sectors. The market is also likely to see a number of disposals of private equity backed assets since managers like BaltCap, East Capital Explorer, Enterprise Investors, NCH Capital and several others are preparing to exit from their historical investments. Commercial real estate sector has all the possibilities to reach yet another all-time highs as established players are looking to spread their investment activity more steadily from Tallinn to Riga and Vilnius.

Another driving force for increasing M&A activity might be driven by long-awaited awakening of Baltic capital markets. Estonia has eased asset allocation rules for pension funds and this should channel more institutional money into local economies. Finally, there are talks about companies considering IPO’s in Baltic OMX and 2016 will likely see increasing number of Baltic corporates selling bonds to international capital markets. Estonian government is restructuring the management of state-owned assets and considers privatising some companies, postal services and logistics company Omniva being the most significant target under review.

European private equity has so far not been too active in Baltics, but this is likely to change as PE firms are seeking to spend record amounts of dry powder they have. Estonia, Latvia and Lithuania are often classified as yet another CEE country whereas economically Baltic economies are closer to Nordics, among the most crowded private equity markets in the world. Yet no Scandinavian PE firm has made any platform investment to Baltic headquartered companies for years. In this and previous reports we have commented increasing venture capital and private equity real estate activity in the Baltics, tendency that has not yet spread to small- and mid-cap private equity segments despite remarkably lower valuations available in the region. Keystone expects this discord to be noticed and eventually European mid-market PE will find their way to Baltics.

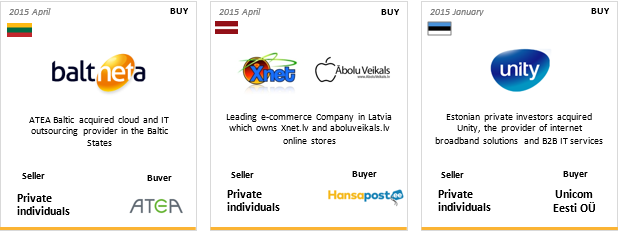

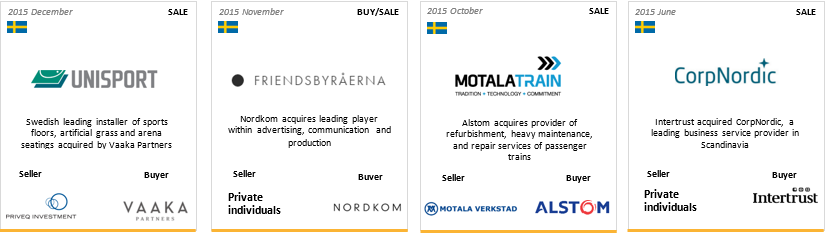

Keystone Advisers deal count – 13 transactions in 2015

During 2015 we have successfully completed 13 M&A deals: six in Sweden, three in Lithuania, three in Estonia and one in Latvia.

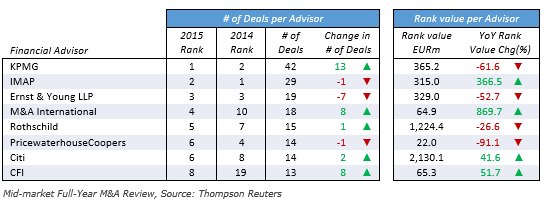

CFI Group leads Eastern Europe mid-market advisory tables

Keystone is a part of Corporate Finance International, a select group of investment banks with established cross-border capabilities and focus on middle market transactions, with an average deal size approximately EUR 10 million to EUR 200 million. Founded in 2006 to deliver best-in-class cross-border M&A services to the middle market, CFI delivers more than a decade of international collaboration among its members, including the successful delivery of over 300 cross-border deals with an aggregate EUR 19 billion of deal value since 2000.

In 2015, members of CFI Group have completed 13 deals in Eastern Europe, ranked eight by the number of deals among mid-market financial advisers (up to $500m). In Europe CFI ranked 14th among mid-market financial advisers (up to $500m) with 70 transactions during the year.

About Keystone Advisers

An independent financial advisory firm providing investment banking services regarding M&A and capital raising situations. For many years we provide highest quality services to our customers based on our long-standing experience and high competence in the field. We have accumulated durable experience with providing various types of financial advisory. Since 2000, Keystone Advisers has successfully completed more than 150 transactions. A wide network of contacts and excellent project management skills ensures the highest quality service to our customers. For more information about our services please contact:

|

TÕNIS

|