Year 2014 sees a continued gradual increase in M&A activity

Following a significant slowdown during the crisis years, M&A activity has gradually increased since the start of 2013. Sale of distressed assets is being replaced by deals that were put on hold during the crisis, as profitability returns to normal levels. Lengthy one to one negotiations have been replaced by sales processes with multiple bidders. Foreign bidders have resumed to take interest in Baltic companies; however most buyers are still local companies.

Overall, the first three quarters of 2014 have seen 201 transactions, more than 20% increase compared to 163 deals made during the same period in 2013. The deal flow was highest in the first quarter with 83 deals, slowing down to 74 and 58 deals in Q2 and Q3, respectively.

Based on deal value, Baltic deals, Jan-Sep 2014, Source: Keystone Watch

Yet, looking at the deal value structure, a more nuanced picture emerges. The vast majority of the deals were low value transactions with deal value not exceeding 5 million EUR. However, while more than half of the deals in the range between 5 and 15 million EUR in value took place in Q1, the situation is exact opposite for the deals above 15 million in value. There were 3 such deals in Q1, and 10 and 11 deals in Q2 and Q3, respectively.

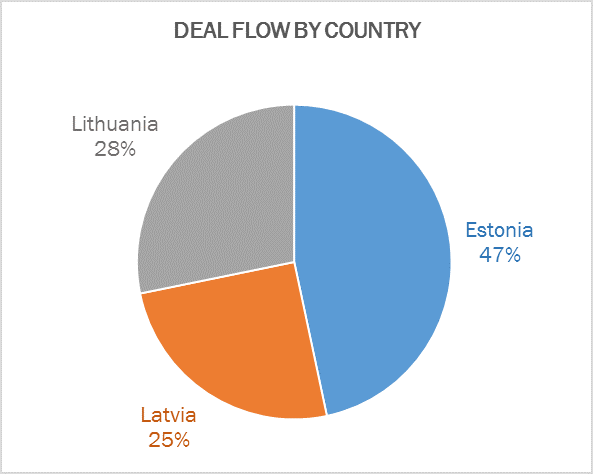

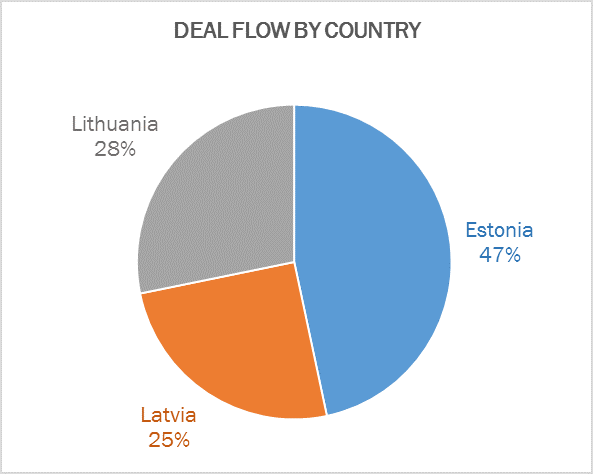

Based on the country of the deal target, Jan-Sep 2014, Source: Keystone Watch

Almost half of deals made in Estonia, while larger transactions taking place in Latvia

Estonia is the clear leader among the Baltic countries in terms of deal flow – 84 deals or nearly half of all the deals in the Baltics targeted an Estonian-based company. Nevertheless, the more sizable deals, i.e. those worth 5 million EUR and above, are split roughly equally among the Baltic states with no clear leader. Yet, with respect to the big deals (worth above 50 million EUR), Latvia took the lion’s share with 4 deals, while there were 2 such deals in Lithuania and only 1 in Estonia.

To highlight the major deals, sale of RSA Insurance Group’s Baltic operations to Polish giant PZU for 364 million EUR was the largest deal in the Baltics so far this year. Gazprom’s exit from Lithuanian gas companies and the sale of the insolvent Latvian steelmaker Liepajas Metalurgs to Ukrainian KVV Group complete the top 3 deals in the period.

Looking at the statistics of participating parties, the number of deals is split roughly equally between intra-Baltic transactions and those that involved a country from outside the Baltics.

Based on type of the deal, Baltic countries, Jan-Sep 2014, Source: Keystone Watch

TMT, Industrials and Commercial Real Estate are the most active industries in terms of M&A

The most deals were taking place in TMT, Industrials and Commercial Real Estate sectors, which together made up 60% of total deal flow in the Baltics. TMT sector is particularly interesting as there is a substantial amount of deals involving IT start-ups, especially in Estonia. The most noteworthy deals were the sale of Estonian-established community engineering platform GrabCAD to global 3D printing leader Stratasys and Latvia’s social networking platform Ask.fm’s sale to Ask.com.

Based on the industry of the target, Baltic countries, Jan-Sep 2014, Source: Keystone Watch

Baltic economies are forecast to be among the fastest growing EU members in 2015

Looking into the future, according to the European Commission forecasts, Baltic economies are going to be among the fastest growing EU members in 2015. With Latvia and Lithuania expected to grow at around 3% and Estonia at 2%.

The positive macroeconomic outlook is expected to continue supporting the already strong business confidence, good growth opportunities and credit availability. Besides increasing the attractiveness of local companies as acquisition targets, relatively good growth prospects also put them in a strong position to make acquisitions themselves. This process is enhanced by the fact that banks are willing to issue secured loan credit at relatively cheap rates. The local banking sector is dominated by the subsidiaries of Nordic banks, which are strong at home and hold favorable view of the Baltic market.

Baltic region enjoys increasing private equity interest

Keystone Baltic M&A Watch indicates increasing private equity activity in the region. Three quarters of 2014 have seen a total of 80 deals with financial investor involvement, 40% of all transactions counted by Keystone. One third of deal flow comes from venture capital segment as seed and growth financing opportunities for fast growing Baltic technology companies have become steadily available. Locally managed VC vehicles are accompanied by global growth investors such as Accel Partners, Intel Capital and Bain Capital Ventures that have all invested in the Baltic based tech ventures.

Buy-out and growth financing segments are relatively immature compared to venture financing opportunities; still, a trend towards increasing activity could be noticed. European Investment Fund backed fund-of-funds vehicle is expected to bring approximately 300 million EUR of new capital to the market and at least five local General Partner teams have taken up the management of that capital. Thus far, however, only BaltCap has managed to reach closing with their new mid-market fund. BaltCap is clearly the most active PE investor in the region by Keystone Baltic 2014 M&A Watch, followed by Eften Capital and East Capital in commercial property sectors.

Baltic countries are now rarely defined as emerging markets and this reflects to private equity market as well. Some corporates and emerging market focused high-growth funds that invested in the Baltic-based companies ten years ago are now selling their portfolio holdings (for example Askembla, Amber Trust) and these assets are often picked up by local entrepreneurs and private investment companies such as UP Invest and My Invest.

Keystone expects the abovementioned trends to continue in 2015 and onwards. Valuations in the Baltic region are significantly lower compared to neighbouring Scandinavian or Western European markets and an increasing number of growth oriented Baltic enterprises are looking to raise equity or mezzanine financing to support their expansion outside the region. Baltic markets are now clearly on the radar for pan-European private equity community.

For more information please contact Mr Tõnis Kons: